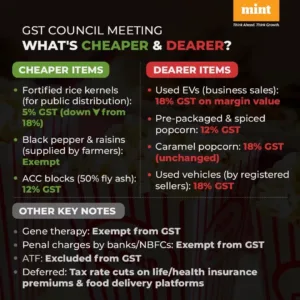

Finance Minister led 55th GST Council decided to levy higher tax rate on caramel popcorn and exempted gene therapy from the tax ambit.

EV Sales:

- To raise the rate of tax to 18 per cent from 12 per cent on all used EV sales, and it will be applicable only on the value that represents margin.

- Margin here means the difference between the purchase price and selling price (depreciated value if depreciation is claimed) – by businesses.

- Sale and purchase of used vehicles by individuals will continue to be exempt from GST.

Popcorn:

- Caramelised popcorn will continue to attract tax at the rate of 18 per cent.

- ‘Ready-to-eat popcorn’, which is mixed with salt and spices, and has the essential character of namkeens currently attracts a five per cent GST if it is not pre-packaged and labelled.

- Additionally, pre-packaged and labelled ready-to-eat snacks/popcorns will attract a 12 per cent tax.

Fortified Rice Kernels:

- GST Council has cut the tax rate on fortified rice kernels used for public distribution to 5 per cent from 18 per cent.

- The finance minister clarified that ACC blocks containing 50 per cent fly ash will attract a 12 per cent GST rate.

- Black pepper and raisins supplied directly by farmers will be exempt from GST.

GST Cess: The GST council provided the reduction of the compensation cess rate to 0.1 per cent on supplies to merchant exporters, aligning it with the GST rate on such supplies.

Exemption:

- The GST Council has totally exempted gene therapy from the ambit of GST. The exemption of IGST on surface to air missiles was also extended.

- The GST Council agreed to keep jet fuel (ATF) out of the ‘one-nation-one-tax’ regime. Regarding the inclusion of ATF under GST, Sitharaman confirmed that the decision was deferred after states raised concerns.

- The finance minister announced that no GST will be levied on penal charges imposed by banks and non-banking financial companies (NBFCs) on borrowers for non-compliance with loan terms.

Concept Note for small companies: On small companies facing registration problems, Sitharaman said a concept note has received in-principle approvals. This may require amendments to be made to the GST Acts to make it easier for small companies to register.